Rich Dad Poor Dad: What I Learned About Wealth, Luck, and Mindset from This Book

There are books you read once and forget, and then there are books that shift something inside you. For me, Rich Dad Poor Dad by Robert Kiyosaki was one of the latter.

At first glance, it reads like a simple tale of two fathers. But underneath the surface, it’s a powerful reframing of how we think about money, success, and the stories we inherit. Whether you’re just beginning your wealth journey or reevaluating your beliefs about financial freedom, this book offers a rare kind of clarity.

Here’s what it taught me about wealth, luck, and the mindset that truly builds both.

1. Wealth Isn’t Just About Money—It’s About Mindset

Kiyosaki contrasts the scarcity thinking of his “Poor Dad” (his biological father) with the abundance mindset of his “Rich Dad” (his mentor). One believed in job security, the other in financial independence.

The most significant shift for me?

I stopped asking, “Can I afford this?” and started asking,

“How can I afford this?” I naturally have a positive mindset, so it was easy.

That one question changes everything. It moves you from passive limitation to active creation.

Whether it’s launching a business, investing in real estate, or building passive income streams, the Rich Dad mentality taught me that money is a tool, not a destination.

2. Understanding Cash Flow Is the Real Game Changer

One of the most practical takeaways from Rich Dad Poor Dad is the concept of cash flow—the money that flows in and out of your life or business.

Kiyosaki urges us to stop focusing on income alone and instead ask:

“Is your money working for you—or are you just working for money?”

Positive cash flow means you’re building assets that generate money even when you’re not working. This could be:

- Rental income from property

- Royalties from books or intellectual property

- Dividends from stocks

- Profits from a business you own

The Poor Dad focuses on a paycheck.

The Rich Dad focuses on systems that generate ongoing income.

3. Assets vs. Liabilities: The Simplest Rule Most People Get Wrong

Kiyosaki simplifies what schools and banks often overcomplicate:

Assets put money in your pocket. Liabilities take money out.

That’s it.

Many people think their house is an asset, but if it’s costing you money every month with no return, it’s actually a liability.

Here’s how I reframed my own money decisions after reading the book:

- I started evaluating every purchase: Does this help generate income or not?

- I prioritized building assets, even small ones at first.

- I became cautious of “lifestyle creep” and shiny objects that quietly become liabilities.

I don’t want to underestimate the importance of a house in contributing to a family’s happiness, but if you’re buying a house thinking it’s a good investment, you should reconsider.

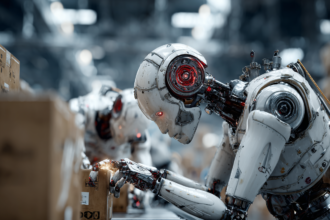

4. Business vs. Job: Which One Builds Freedom?

This was one of the most eye-opening shifts for me. Kiyosaki explains that while a job gives short-term security, a business offers long-term freedom.

Here’s a simple comparison inspired by the book:

| Job (Poor Dad Mindset) | Business (Rich Dad Mindset) |

|---|---|

| Earns active income (you work, you earn). | Builds systems to earn passive income. |

| Dependent on the employer for financial safety. | Self-reliant; income comes from ownership. |

| Your paycheck stops if you stop working. | Income continues even when you’re not working. |

| Promotions and raises are limited by hierarchy. | Income potential is scalable and unlimited. |

| High taxes (income taxed first). | Tax advantages through business deductions. |

| Fear of failure, seeks stability. | Accepts risk and learns through mistakes. |

This table changed how I viewed work forever.

Jobs still have their place, especially when building skills, networking, and accumulating funds to invest in your business. But if freedom is your end goal, building or owning something is what opens that door.

5. Luck Favors the Financially Literate

There’s a popular myth that wealth is about being in the right place at the right time. But Kiyosaki dismantles that. His version of “luck” is grounded in preparedness and knowledge.

Opportunities are everywhere—but only the financially literate recognize them.

After reading this book, I committed to learning how money actually works:

- What are assets vs. liabilities?

- How does cash flow work?

- What makes something a wise investment?

Financial education became a personal priority—not just saving or budgeting, but understanding how to grow money.

6. Your Circle Matters More Than You Think

Kiyosaki’s Rich Dad surrounded himself with entrepreneurs, investors, and thinkers. That wasn’t luck—it was intentional.

Who you learn from becomes what you believe is possible.

After reading this, I began curating my own “Rich Dad circle”—books, mentors, podcasts, even peer groups that encouraged growth, not fear.

Recap: It’s Not About Being Rich—It’s About Being Free

What I love most about Rich Dad Poor Dad isn’t the money talk—it’s the freedom talk.

It’s about reclaiming your time, your choices, and your path.

If you’ve never read it—or if it’s been years since you have—I encourage you to pick it up again. Sometimes, the second read is even more potent than the first.

Rich Dad Poor Dad – This book is still one of the best introductions to mindset-driven wealth building. Add it to your personal library or revisit it with fresh eyes.

Available on Amazon Below: